3-minute read

In the world of insurance, competition is stiff. Insurance companies reply on predictive analytics to give them a competitive edge to reduce risk, retain customers and adjust pricing.

With predictive analytics tools, insurers can create behavioral models using data to understand and evaluate possible outcomes that can affect their business.

What are the biggest problems insurers face?

Fraud comprises about 10 percent of property-casualty insurance losses and loss adjustment expenses each year, equating to $40 billion. The more fraud that occurs, the more everyone pays for their insurance policies, so fraud is always top of mind for insurers.

• The use of predictive analytics can flag these claims and provide recommendations on legitimacy, minimizing loss.

• Predictive analytics models can process huge amounts of data and transactions to detect patterns of suspicious activities.

Customer loss h¬as devastating effects on insurers. According to a study from Forbes, companies across the US are losing a staggering $62 billion per year due to issues like poor customer service. Gaining insight into which customers might be at risk to leaving, gives an insurer the ability to predict and plan ahead.

• Predictive analytics can alert an insurer that a customer may be at risk of leaving based on key words customers are searching, which areas of the insurer’s website they are visiting, and what content they are viewing, i.e. activity around new and competitive offers.

• Insights gained from data-based predictions can provide a framework for insurers to make powerful changes in how they communicate with their current customers and what offers to provide them.

How does the predictive analytics process work?

The process involves extracting information from historical and current data to build a mathematical model that depicts important trends, or to see what will happen next, giving an insurer important insight, so they can be ready for challenges down the road. Data on pricing, risk, customer interactions, expenses, and profit form a picture for insurers, so that premiums can be adjusted when needed.

Let’s look at an example.

Dashboard example

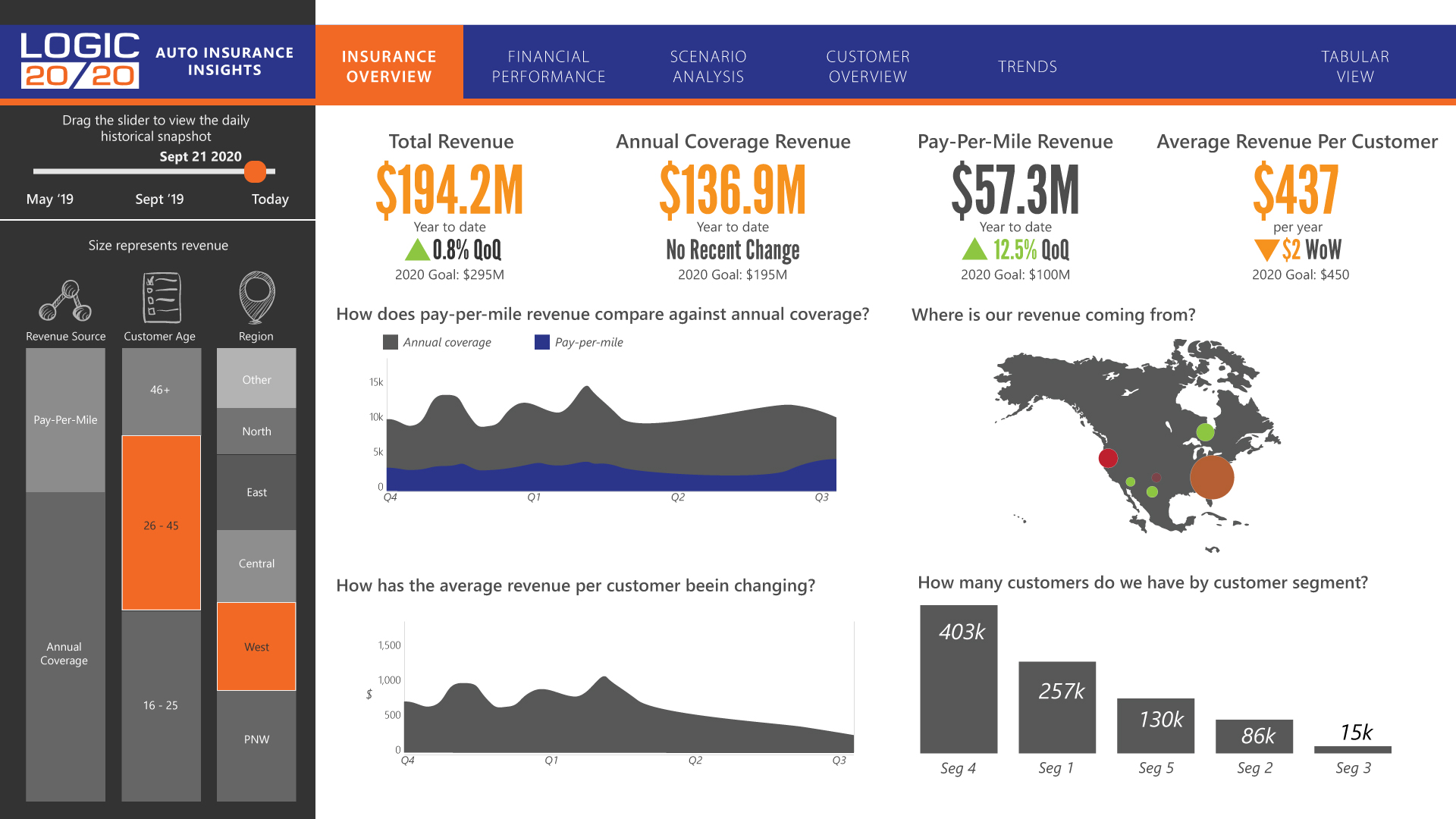

This fictional business dashboard focuses on auto insurance insights.

This dashboard shows us an overview of the split between the two primary sources of revenue generation: traditional annual coverage versus pay-per-mile. Pay-per-mile programs charge a daily or monthly base rate that is based on factors similar to those used when setting rates for a traditional insurance policy.

Over the past few years, a handful of insurance companies have started offering pay-per-mile programs. For drivers who aren’t constantly on the road, these programs could offer an opportunity to reduce car insurance costs. But what about revenue for the insurers?

The visual is intended to help insurers answer the question, “Should we change our strategy to focus more on pay-per-mile options for our customers?”. Executives can use a dashboard like this to rapidly drill down on specific customer segments, regions and more.

Ways predictive analytics help insurers:

-

Needs

- Forecast fraud tendency scores

- Identify behavior patterns

- Designed customer care ecosystem

- Identify customers who may cancel

- Low conversion rates

-

Logic20/20 Capabilities

- Data Mining

- Statistics

- Modeling

- Machine Learning

- AI

-

Business Outcomes

- Decrease in fraud

- Identify potential markets

- Timely responses in customer care

- Find risk; create mitigation plan

- Data analysis & segmentation

Predictive analytics provides savings:

Two-thirds of insurers credit predictive analytics with reduce issues and underwriting expenses, while 60% say the data helped increase sales and profitability.

of insurers credit predictive analytics with increasing sales and profitability

a year is lost due to insurance fraud

a year is lost due to poor customer service and customer care

Get a better understanding of your data

Predictive analytics can help insurance companies with cost savings and revenue streams by creating strategies for pricing and marketing, while streamlining operational efficiency for claims and underwriting.

As insurers look ahead into the coming year, they will use the increased variety and sophistication of data sources collected to stay ahead and make better informed decisions. Predictive analytics will continue to be a critical value at the forefront to increase sales and reduce expenses.